Browse gas: Expensive, emissions-intensive, unnecessary

Download Full Report

View Press Release

Key Findings

Woodside’s Browse gas project is unlikely to be competitive either domestically or internationally, based on IEEFA cost estimates.

Browse gas is likely four times more expensive than existing domestic gas and could depress industrial demand. Diverting cheaper LNG feedgas would be a better solution for Western Australia’s energy security.

Browse LNG may struggle to find buyers in an oversupplied global market. Potentially 60% more expensive than Qatar’s LNG, it is likely twice the price needed to unlock new demand in Asia through coal-to-gas switching.

The project’s carbon-intensive gas and reliance on costly, unreliable carbon capture could push project costs up by about 9% and drive carbon prices higher for everyone.

Woodside’s Browse gas project, located in ecologically sensitive waters off Western Australia (WA), is intended to replace the declining legacy fields supplying the North-West Shelf (NWS) liquefied natural gas (LNG) project. Woodside and the WA government have argued that the project is needed for energy security and to support decarbonisation in Asia by displacing coal. However, less focus has been given to the risks arising from the Browse project, for investors, WA and Australia more broadly.

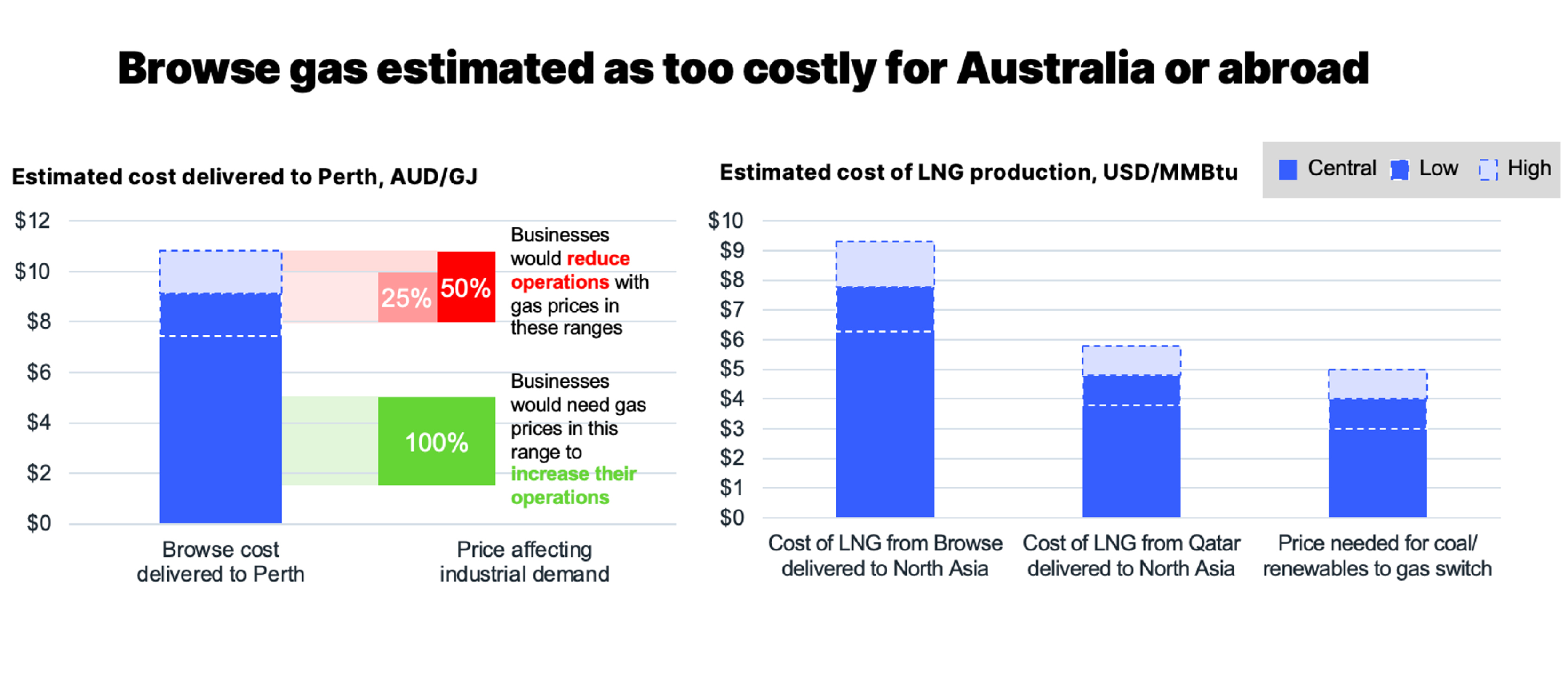

Despite being discovered more than 50 years ago, the Browse gas field remains undeveloped, likely reflecting the project’s complexity and cost, estimated by IEEFA at more than AU$37 billion. Based on financial modelling using data supplied by Woodside Energy and independent experts, as well as other data sources, IEEFA estimates the cost of Browse gas at AU$7.80 per gigajoule (GJ), with a cost of more than AU$9/GJ delivered to Perth, This is more than four times as expensive as the production costs of existing domestic gas. This means Browse is likely to either be uncompetitive or drive up WA gas prices. The Australian Energy Market Operator (AEMO) previously found that prices around AU$8/GJ would start driving operations reductions by industrial users, underscoring the potential impacts of high gas prices.

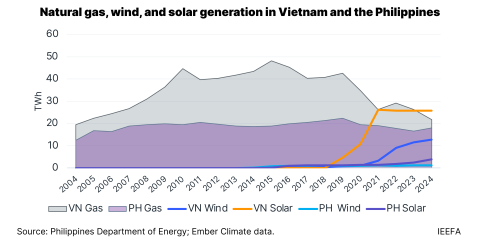

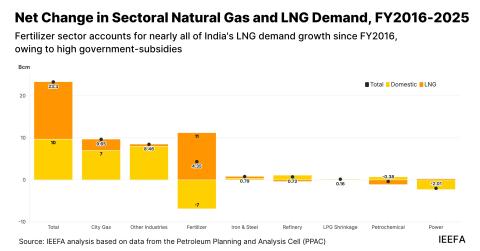

LNG from Browse is likely to be similarly uncompetitive, with IEEFA estimating a cost of US$6.8 per million British thermal units (MMBtu), leading to a cost delivered in North Asia of about US$7.8/MMBtu, about 60% higher than Qatar’s LNG. Qatar is widely expected to have large, unsold volumes of LNG, estimated at more than WA’s total LNG export capacity (including Qatari LNG contracted by portfolio players that will need to find end buyers). Browse LNG is also likely to struggle to compete with – and therefore displace – coal in Asia. The International Energy Agency (IEA) has found that LNG prices would need to fall to US$3-5/MMBtu to trigger coal-to-gas switching, nearly half of the estimated cost of Browse LNG. More generally, IEEFA’s analysis of China and India, two of the world’s largest coal consumers, clearly shows LNG is not displacing coal due to its high cost compared with alternatives.

High emissions likely to increase costs by more than 9%

The government’s recent approval of Woodside’s proposed NWS extension includes emissions reduction requirements that are likely to make it uneconomic to keep the project’s two older LNG processing trains online, or add significant costs to upgrade them. This could reduce LNG production and revenue, as well as increasing the estimated cost per unit of LNG production. IEEFA has accounted for this possibility in a “high-cost scenario”, in which two of the five NWS trains are available to process gas from Browse.

The Browse fields are also carbon dioxide (CO2)-intensive, with an average concentration of about 10% CO2, higher than many other gas fields (for example, the Scarborough field has about 0.1% CO2). Development of the Browse field will bring with it material emissions estimated by Woodside to be as high as 6.8 million tonnes of CO2 equivalent (MtCO2e) in a peak production year (assuming no abatement and a high reservoir CO2 scenario). This would represent 2.9-3.7% of Australia’s emissions in 2035.

However, Woodside has indicated it intends to abate some of the emissions through carbon capture and storage (CCS), in part to meet its obligations under the Safeguard Mechanism to have net zero reservoir CO2 emissions from day one. In Australia, Chevron’s similarly sized Gorgon CCS project has cost AU$3.2 billion to date, and IEEFA estimates the Browse CCS facility could add about 9% to the project’s costs.

While often proposed as a solution for project-related emissions, CCS has a history of failure and underperformance. The Gorgon CCS facility has captured less than half of its target since starting operations, and only stored about one-third of the CO2 it captured in fiscal year (FY) 2023-24. This has imposed additional costs on Chevron, requiring it to surrender carbon credits on top of the already high costs of CCS. IEEFA estimates a cost of AU$222/tCO2 for its FY2023-24 CO2 injections.

Woodside anticipates CCS will abate 47% of upstream emissions. Residual reservoir emissions will need to be fully offset with carbon credits, which could increase carbon credit demand and prices, driving up carbon costs across the economy.

Not essential for energy security – in WA or in Asia

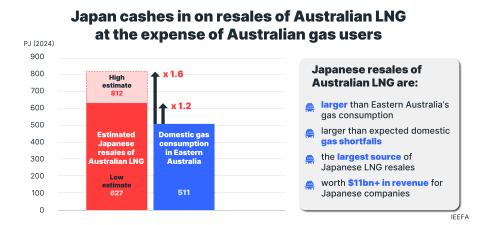

WA is Australia’s largest gas-producing state by far. In 2024, only about 418 petajoules (PJ) of gas was supplied into the domestic market, compared with about 3,350PJ of gas production (excluding gas produced and used in upstream gas extraction).

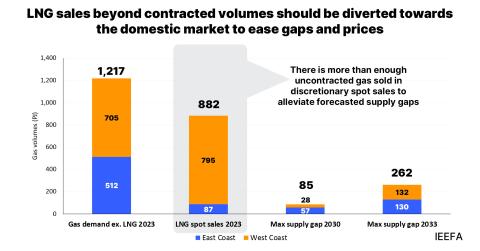

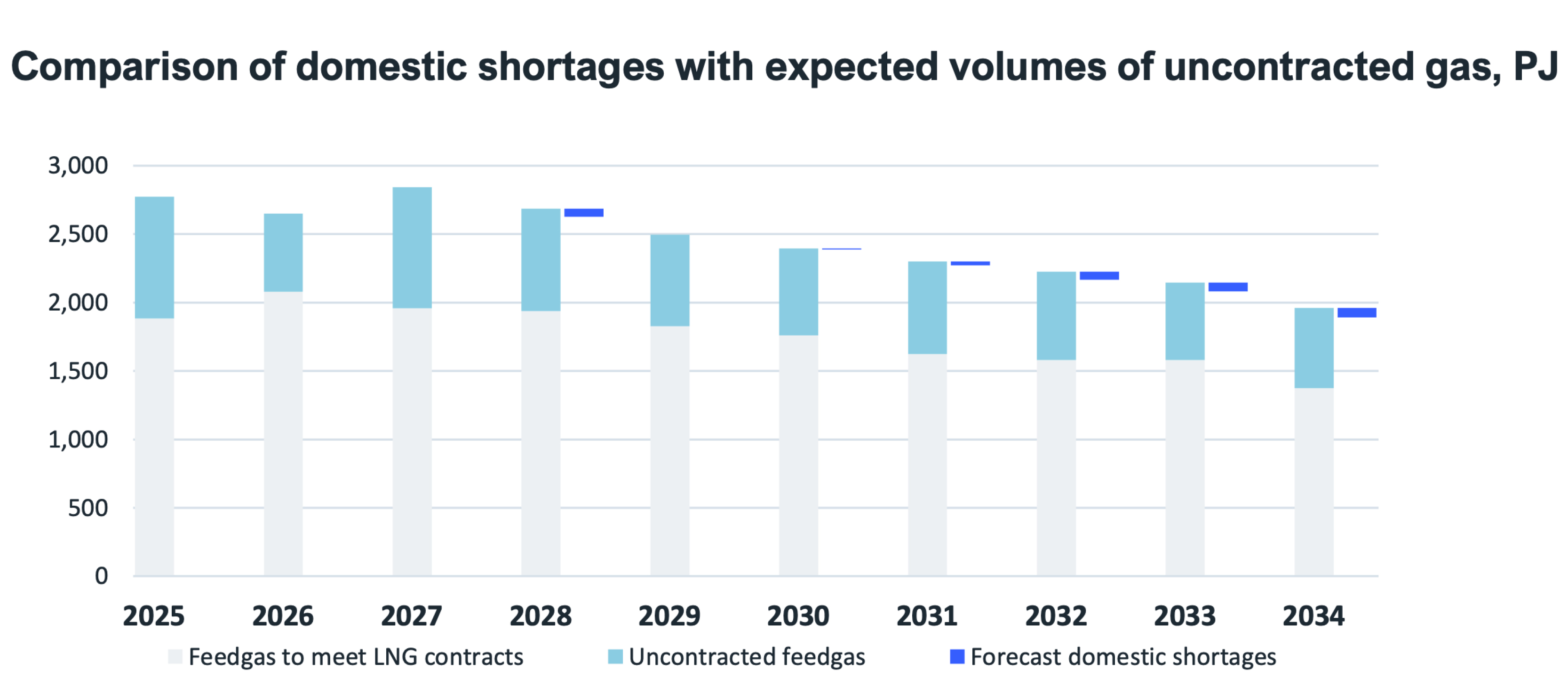

Nonetheless, declining production at legacy fields is having an impact on domestic gas supply, with AEMO warning of potential gas shortages from 2030. However, these shortages are small relative to total LNG exports and estimated future uncontracted LNG volumes. For instance, IEEFA estimates AEMO’s forecast shortage in 2034, of about 70PJ, is equivalent to just 12% of estimated uncontracted feedgas and only 4% of total feedgas for all LNG exports. Rather than relying on potentially expensive gas from Browse, there is an opportunity for governments to consider policy measures to redirect small amounts of gas into the domestic market that would otherwise be exported as spot LNG. This would address supply concerns, likely with minimal impact on gas production costs and prices in WA.

IEEFA also notes that forecast shortages could be lower if AEMO were to account for gas LNG exporters might need to supply to meet their domestic market obligations. Under the state’s reservation policy, LNG exporters are required to supply 15% of LNG production to the domestic market, but a WA Parliamentary Inquiry found that only 8% had been supplied. This means LNG producers are likely to have to supply more than 15% in coming years, which is more than AEMO assumes in its supply forecasts. (AEMO assumes a flat 15% of expected LNG exports.)

There are also cost-effective opportunities to reduce WA’s gas consumption, particularly in electricity generation and industrial processes. This includes opportunities for a faster rollout of renewable energy in grid and off-grid electricity systems, and the electrification of alumina production (which would require initial government support).

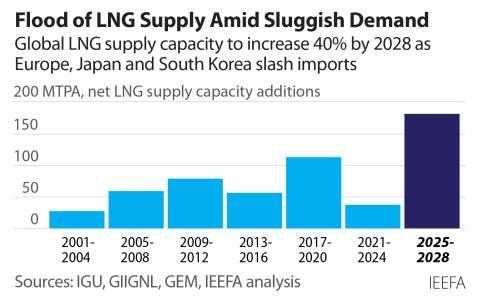

Browse is also not needed to support energy security in Asia. Internationally, LNG markets are seeing an unprecedented tidal wave of new supply, with LNG capacity expected to surge by 60% by the early 2030s. Meanwhile, LNG demand growth remains highly uncertain. The IEA predicts that existing and under-construction LNG capacity will be more than sufficient to meet global LNG demand to 2040, even under its slowest transition scenario. In the shorter term, the IEA expects oversupply to be so material that if all that additional capacity was absorbed, prices would likely drop to well below the estimated cost of the Browse project.

The analysis in this report raises significant questions regarding the benefits of the Browse project, which IEEFA anticipates will impose higher gas prices on gas users and increase emissions, while not contributing to energy security or displacing coal in Asia.

More details on the parameters and assumptions underpinning this report’s findings can be found in a separate Technical Appendix. To read the Technical Appendix, click below.

Read more in the accompanying fact sheets: Browse is not the right solution for Western Australia; and Asia does not need LNG from Browse.